In the dim, dark past (4 weeks ago), things were simmering.

The top end was doing nicely. A sale here, another there. Mostly home-grown buyers. Some so big they hit the news, most behind closed doors.

Rumblings were heard off-shore and lower down the ladder. But why hang around waiting for a crash when you can blow things up yourself by overloading the market?

The readers of leaves must have been tippling something headier than they could safely handle — they started foretelling a boom big enough to swallow prices that flew.

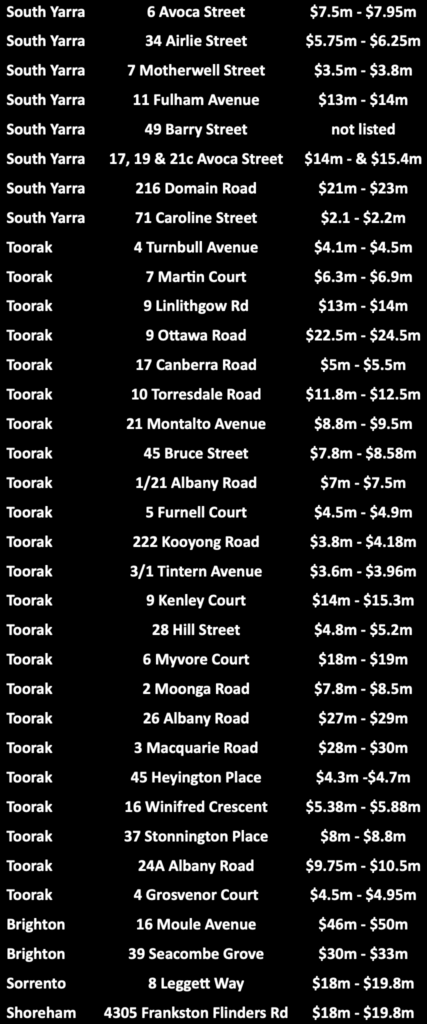

Suddenly a market that had counted just six sales of $30m+ was open for inspections all over. Even Brighton (Brighton!) had two between $30m and $50m.

Meaning?

If you’re selling, be prepared to call home, home, a while longer. If you’re buying, be aware that a typical crash comes via 1,000 cuts and not One Big Crash.

Wait a while.

This? This is not normal…

Has so much ever been thrown onto the market so close to Christmas?

One Very Small Street In South Yarra

A good street. Three homes for sale between $12-18m.

Eenie, meenie, minee, no mo.

“We’ve got an offer of $8.5m.”

Really? We’re not interested.

“We can offer a long settlement date.”

That’s interesting. Your $8.5m offer went away?

“Um.”

We saved a million.

Dork Of The Month Award

Agent sells a home to a neighbour. Due diligence ignored.

It goes for $2m less than a buyer we know would have paid.

There’s a learning curve but it can take young players a while to learn that.

In the meantime…